A version of this article was first published on Betakit in March, 2021.

In 2019, I wrote an article on how the CRA had become tougher on SR&ED claims despite the declining number of reviews. However, the latest data shows that the CRA has been working hard to support the tech community during the COVID-19 pandemic.

2020 was brutal for most and an opportunity for others. One interesting knock-on effect of the pandemic, however, has been the accelerated rate of digital adoption in many sectors of the economy. With technology companies driving the digital economy in the country, the Canadian government and the CRA have worked hard to support tech companies throughout this unprecedented year.

There are two main areas where the CRA is working to support our digital economy:

- Ensuring that companies that comply with the SR&ED program guidelines receive the refunds they entitled to

- Reducing the number of reviews so companies can focus on their employees, clients, and health and safety protocols

Reviews result in more money for companies

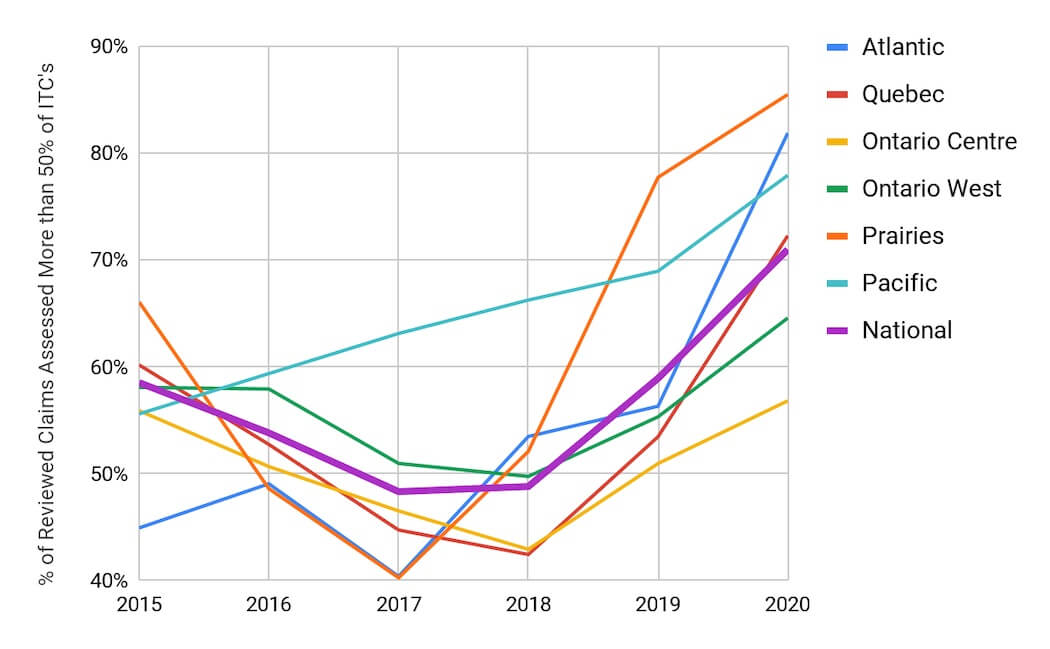

Since 2018 The proportion of SR&ED claims that receive more than 50% of the tax credits claimed after a review has skyrocketed in all tax offices. That year, there was less than a 50% chance businesses would get more than half of what they claimed if selected for a review.

In 2020, however, there was a 70% chance a company would get more than 50%. This uptick could indicate that the claim preparation is improving and that consultants and taxpayers are more compliant. However, the trend could also illustrate a greater consistency within the CRA, leading to the general acceptance of more tax credits.

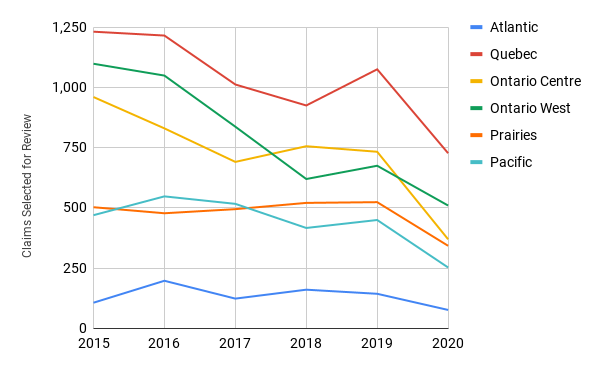

Early in the pandemic, many claims were in the midst of a review. 2020 saw a total of 2,280 claims selected for review (compared to 3,600 in 2019). Most of the claims selected for review were chosen in the first three months of 2020.

The numbers may be slightly skewed as the CRA was hampered for a few weeks when the pandemic first hit. When it reopened, many of the claims that were selected for review were approved as filed. These approved filings were largely due to the fact that the CRA simply did not have the tools or systems in place to transition to remote administration of reviews. However, this does not give those businesses a free pass. The CRA reserves the right to revisit claims filed in 2020. A claimant found to have been paid incorrectly will need to repay the funds.

With all of the year’s upheaval, there were still significant regional differences. In the Prairies, for example, 85% of companies received more than 50% of the tax credits after review. In contrast, only 57% of Ontario Centre companies received more than 50% of the tax credits after review. One needs to ask what is the CRA is doing to level the playing field for all tech companies across Canada? There may be an explanation for the variability, it’s important to look at more data first.

SR&ED: Increasingly more attractive

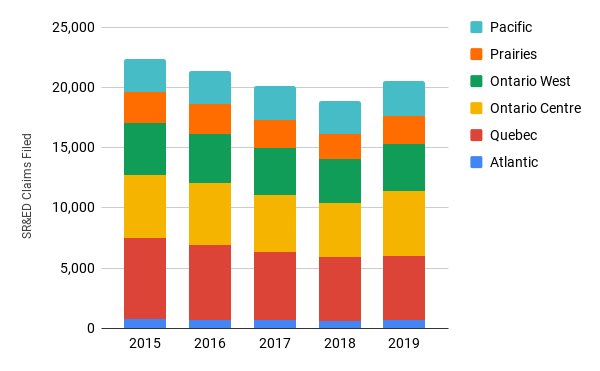

There is more good news coming out of the latest figures for the SR&ED program. In 2019 and 2020, the total number of SR&ED claims exceeded 20,000. This was primarily driven by the Ontario Centre region, which saw a 20% increase in claimants from 2018 to 2019. The rise in Ontario Centre represents more than half of the national rise in claims. As the economy in Ontario did not grow disproportionately to the rest of Canada, it is most likely the result of SR&ED consultants focusing more of their business development efforts in this region. No doubt, it has led to a more significant number of claimants.

Is it possible that the significant increase in claimants was due to an overly aggressive consulting firm submitting claims? This would explain the relatively poor review results in Ontario. I doubt we will ever really know if the CRA is actually tougher on claimants in Ontario Center or if claims are more aggressive due to ill-advised guidance from SR&ED consultants.

SR&ED claims selected for review plummet

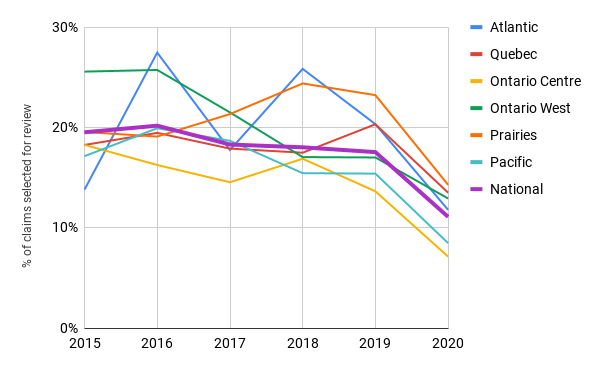

The CRA has been relatively consistent in selecting approximately 18% of claims for review from 2017 to 2019. In 2020 only 11.1% of claims were selected for review. To put that into perspective, a significant majority of the claims were selected for review before COVID-19 and very few in the second half of 2020.

The CRA is doing the right thing by allowing taxpayers to focus on R&D, sales & marketing, and, in some cases, surviving the pandemic. Reviews do take time away from the core business and do not add value to clients. However, the CRA must conduct reviews to ensure that taxpayer money is going where it should.

COVID has led to an economic crisis. And so, it’s important that we all work together, support each other, and hold each other accountable. The CRA has a difficult job of administering billions of dollars of taxpayer money to companies doing R&D. With the reduction in reviews, it is critical that taxpayers are compliant with the SR&ED guidelines. While submitting a non-compliant claim may seem like a good idea in the short term, doing so can have far-reaching consequences further down the line.

It is crucial to ensure claims are submitted properly as the CRA is reserving the right to review claims submitted in 2020 even after they have been refunded. Potentially, this means that a business could receive a refund, spend the money, and find out in 2021 (or later) that they owe the CRA their 2020 SR&ED. On top of that, there could be interest and penalties levied against the company, potentially putting it in a very difficult financial position. If an organization is not certain of its R&D qualifies under the SR&ED program, it’s advisable to consult a reputable expert – (or two)

It has been common knowledge that a taxpayer should expect a review, on average, every five years. That said, some claimants have reviews far more frequently. This may be due to:

- The claim’s size

- Changes in the claim from prior years, or

- Previous CRA reviews

Some clients, on the other hand, have not been reviewed in many years. These claimants should expect a review. After all, the main reason Canada has a SR&ED program is to promote innovation for homegrown companies. This allows them to build a competitive advantage, grow locally, hire more people, and eventually pay more taxes.

Business location plays a role in refund amounts

Why are there different adjustment rates (the reduction in the SR&ED refund or the percentage of the claim denied by the CRA) between tax centres? And why, for example, does the Prairies tax centre select twice as many claims to review compared to the Ontario Centre?

A company headquartered in the Prairies would have the lowest adjustment rate in Canada. Conversely, a company in Ontario Centre would have the highest. This is not a small difference. In fact, the Ontario adjustment rates are almost three times as much as the Prairies. However, the Prairies also selects twice as many claims for review as Ontario Centre.

So, would you rather be in a region with a lot more reviews that generally you receive a better result after review or a region that has fewer reviews but you’re probably going to get less after review? You probably don’t have a choice as you’re not moving your company so the question is for the CRA why there is a difference? Perhaps it is a regional resource allocation or the way reviews are conducted in each region. Whatever the reason, companies relying on the SR&ED program deserve consistency and fairness across the country.

Denied SR&ED claims

One of the most painful experiences for a company is the denial of its SR&ED claim. There is a wide variety of reasons why this happens. If the Research and Technology Advisor (RTA) decides the submission does not qualify for the SR&ED program it may mean that:

- An individual preparing the claim was misinformed of the qualifications

- The consultant was overly aggressive

- A new RTA determined the claim did not meet the SR&ED qualification criteria

Regardless, when a company expects a refund but receives none, it can hurt the organization’s bottom line. However, overall, rejections are on a downward trend. This is where we see the most significant change in the SR&ED program.

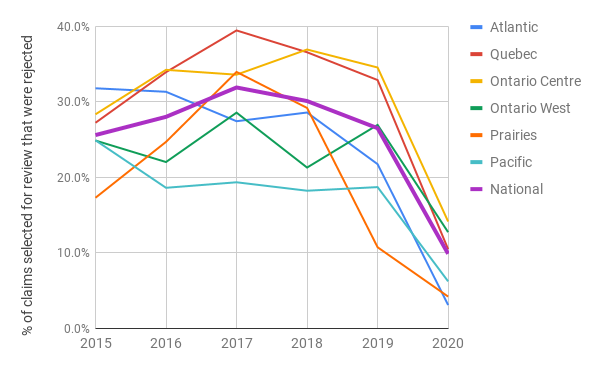

From the peak national average of claims rejected after review (31.9% in 2017), rejections have dropped to less than 10% in 2020 across the country. Once again, this is likely due to the ongoing pandemic.

The CRA and innovation

Looking back at 2019, we can see that the SR&ED program is becoming more predictable and streamlined. There are more claimants and the number of claims selected for review is stable. Additionally, reviews resulted in better outcomes than the previous years. Yet, there continue to be regional disparities that are challenging to explain.

In 2020, the CRA did its part in supporting our rapidly evolving economy to assist technology companies via the SR&ED program. Fewer companies were selected for review, and those selected had higher chances of success with the CRA processing refunds much more quickly.

In the past, it was common that a SR&ED refund for a claim (not selected for review) would take two to three months to be assessed and have a refund cheque issued. Now, we see the CRA taking one to four weeks to issue a notice of assessment for corporate tax returns and directly depositing funds. This has allowed tech companies to better manage their cash flow in challenging circumstances.

The SR&ED program seems to be on the right track. Overall, there are more claimants who seem to understand the program better. This may be the result of quality consultants, technical reviewers, and financial reviewers, or it may be the consequence of a maturing program. Whatever the reason, we know that many Canadian technology companies rely on the SR&ED program to remain competitive – especially during the pandemic as for many companies, this refund may very well be a lifeline.