Reading time: 5 minutes.

SaaS (Software as a Service) firms are one of the fastest expanding parts of the global economy. They have transformed the way software companies sell today. Many of the most valuable tech companies in the world are SaaS companies because they have the potential to grow quickly with high gross margins. However, one significant challenge facing SaaS companies is their revenue model, which typically requires 50% or more investment than traditional software companies.

Historically, companies developed software, sold it to customers, and charged an annual maintenance fee. When the software was sold, the company received a significant amount of cash that it could use to fund the company. However, most SaaS companies generate revenue on a monthly or annually recurring basis. Consequently, the large cash injection that software companies typically use to fund their company does not exist with the SaaS model of charging for the software every month. This change causes companies using a monthly recurring revenue model to need significantly more investment in the early stages of its evolution. In this article, we will discuss the SR&ED program, its underlying requirements, and the application process from the standpoint of a SaaS company and why it is so important to cash flow.

SR&ED, a large tax program for innovation in Canada

One of the most popular tax initiatives in the Canadian technological ecosystem is SR&ED. This federal and provincial tax credit allows firm owners to deduct eligible expenses when filing their tax returns, including salaries, materials, technical contractors, overhead, other expenditures, and third-party payments. The Canada Revenue Agency (CRA) provides over 20,000 claimants with more than $3 billion in SR&ED tax incentives each year.

While many firms are aware of SR&ED, they are frequently uncertain of which development activities qualify.

Understanding the eligibility requirements

For SaaS companies to be eligible for the SR&ED tax incentive, an experiment or analysis must be conducted to further scientific knowledge or produce a technical advance.

As such, a new or enhanced method or approach to solving problems is required to qualify for the SR&ED initiative. In more detail, this essentially comes down to whether the development:

- Was in response to scientific or technological uncertainty.

- Involved in the formulation of hypotheses specifically aimed at reducing or eliminating that uncertainty.

- It included the formulation and testing of hypotheses through experiments or analysis.

- The overall approach was consistent with a systematic investigation or search and aimed at achieving a scientific or technological goal.

The refund is likely to get granted if all of these criteria (in addition to other requirements) are present.

It’s important to remember that a SR&ED claim can only be approved if a scientific technique was utilized to address a technological problem. Indeed, many software development efforts are not classified as SR&ED because they do not require experimentation and do not result in technological advancement. The constraints of the existing technology and the assumption of improved technology would have to be documented extensively to highlight a real technological advancement.

What can companies recover?

The table below provides a breakdown of the recoverable SR&ED expenditures.

Expenditure | Qualification |

Salaries/wages | Yes |

Materials consumed | Yes |

Materials transformed | Yes |

Overhead | Yes, under the traditional method |

Third-party agreement involving SR&ED | Yes, but only the SR&ED part |

Source: Canada.ca

On qualified SR&ED expenditures of up to $3 million, Canadian-controlled private firms (CCPCs) can obtain a refundable Investment Tax Credit (ITC) at a 35% enhanced rate. On amounts over $3 million, the ITC is provided on a non-refundable basis at a rate of 15%. Other companies (non-CCPCs) may qualify for a 15% non-refundable ITC on their eligible expenditures, which can then be used to lower their tax liability.

Difference between employees and contractors.

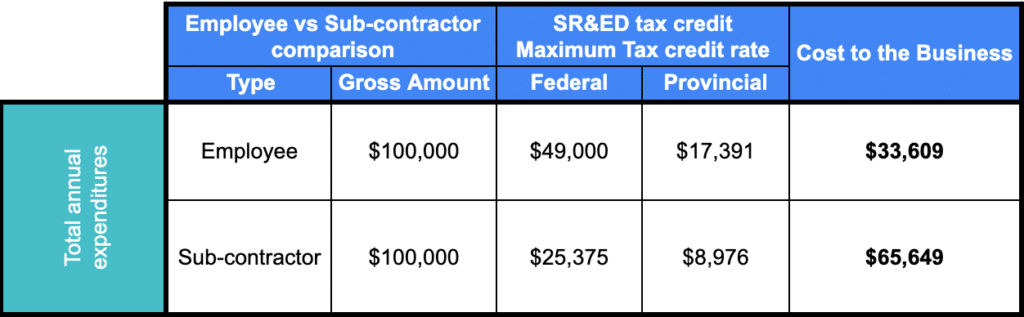

It is important to emphasize a specific point regarding salaries: Although both employees and subcontractors fall under the SR&ED umbrella, they are treated differently.

The calculations above are for a SR&ED claim in the Province of Ontario.

Source: Venbridge SR&ED Calculator

The cost-benefit of hiring an employee rather than a contractor is demonstrated in this scenario. The government is more interested in producing long-term employment, which explains why there is about twice the SR&ED support for hiring employees.

A widespread assumption is that SR&ED is only available to large corporations, whereas it is available to all types of businesses, including sole proprietorships and solopreneurs. Consequently, start-ups at all stages of their development, from pre-revenue through commercialization, can take advantage of this resource.

It makes no difference whether a company is earning revenue. SR&ED is only related to expenses; Companies can file a claim as long as they have eligible expenses.

Software contracts claim.

For a software contract to qualify for SR&ED, many criteria must be clearly defined in the contract to ensure its eligibility:

- The contract must indicate that the claimant controls the project, not a third party.

- The contract must demonstrate that the claimant bears all financial and other project risks.

- According to the contract, any intellectual property emerging from the project should be solely owned by the applicant.

It is also crucial to note that, to claim any SR&ED subcontractor fees, it must always explicitly state that the company is paying for third-party services in the contract.

The application process

A company must file an income tax return and attach a completed Form T661 to claim SR&ED expenses. This form includes collected technical data and calculated eligible expenditures for the ITC. Usually, SR&ED claims are processed quickly, but processing can take up to a year if it is selected for review by the CRA.

To support a submitted SR&ED claim for software development, companies must keep supporting evidence, such as documents and other information. These documents will demonstrate that eligible work was completed and eligible expenditures were incurred in the claim year. This information should show:

- What work was done.

- Who was involved in the job.

- When it was done.

- How the expenses were related to the activity.

As the process can quickly become confusing, many companies hire a SR&ED consultant to assist them with their claim. Consequently, the Venbridge SR&ED Consultant Directory is a valuable tool for finding a local consultant that fits your company’s needs.

Venbridge SR&ED Financing

Cash is king in all startup and scale up companies. Because SaaS companies burn cash quickly, they need to be well-capitalized. Venbridge finances accrued SR&ED so that you receive much-needed capital each quarter to grow your business.

Rather than waiting for months after the end of your fiscal year, you can receive the SR&ED refund as you’re spending money on R&D. Many companies love this as it significantly reduces the need to raise capital through equity, which in turn, reduces dilution for founders. Consequently, many successful entrepreneurs fund their businesses with a combination of debt and equity so that when they sell or go public, they have more wealth.

Venbridge empowers businesses to maximize their SR&ED claim by providing immediate cash flow to eligible companies in as little as three business days, eliminating the usual long waiting period for capital.

If your company has an eligible SR&ED claim, connect with our team to get immediate access to cash flow and grow your business instead of waiting for your tax credit from the CRA.

This document is for information and illustrative purposes only. It is not and should not be regarded as tax advice or as a recommendation regarding a course of action, including without limitation, as those terms are used in any applicable law or regulation. No part of this document may be reproduced in any manner, in whole or in part, without the written permission of Venbridge except for your internal use.