Reading time: 2 minutes

Since the government announced the Canada Emergency Wage Subsidy (CEWS), questions on whether it will have an effect on the amount that can be claimed for SR&ED have arisen. As of today, it is unclear if CEWS will have no effect, little effect, or devastating effects on SR&ED claims. The Canadian Department of Finance has announced: “Assistance received under either wage subsidy reduces the amount of remuneration expenses eligible for other federal tax credits calculated on the same remuneration.” CEWS is considered government assistance under the Income Tax Act.

The core of the challenge for the CRA is that in the past the interaction between programs such as IRAP and SR&ED has been clean-cut as both programs relate to R&D. However, in the SR&ED tax form, T661, there is no requirement to list the number of employees involved with SR&ED eligible activities and therefore there is no way to apportion the CEWS to SR&ED-eligible activities vs. work that does not qualify for SR&ED.

One way to have this matter sorted is to have the company indicate the employees that are involved with SR&ED-eligible activities during the time of the subsidy when companies apply on the portal. This will be a clear way for the company to attest to which employees are qualified for both government assistance and SR&ED. Even simpler, do not count the CEWS benefit as government assistance for SR&ED purposes.

How CEWS could affect 2020 SR&ED claims

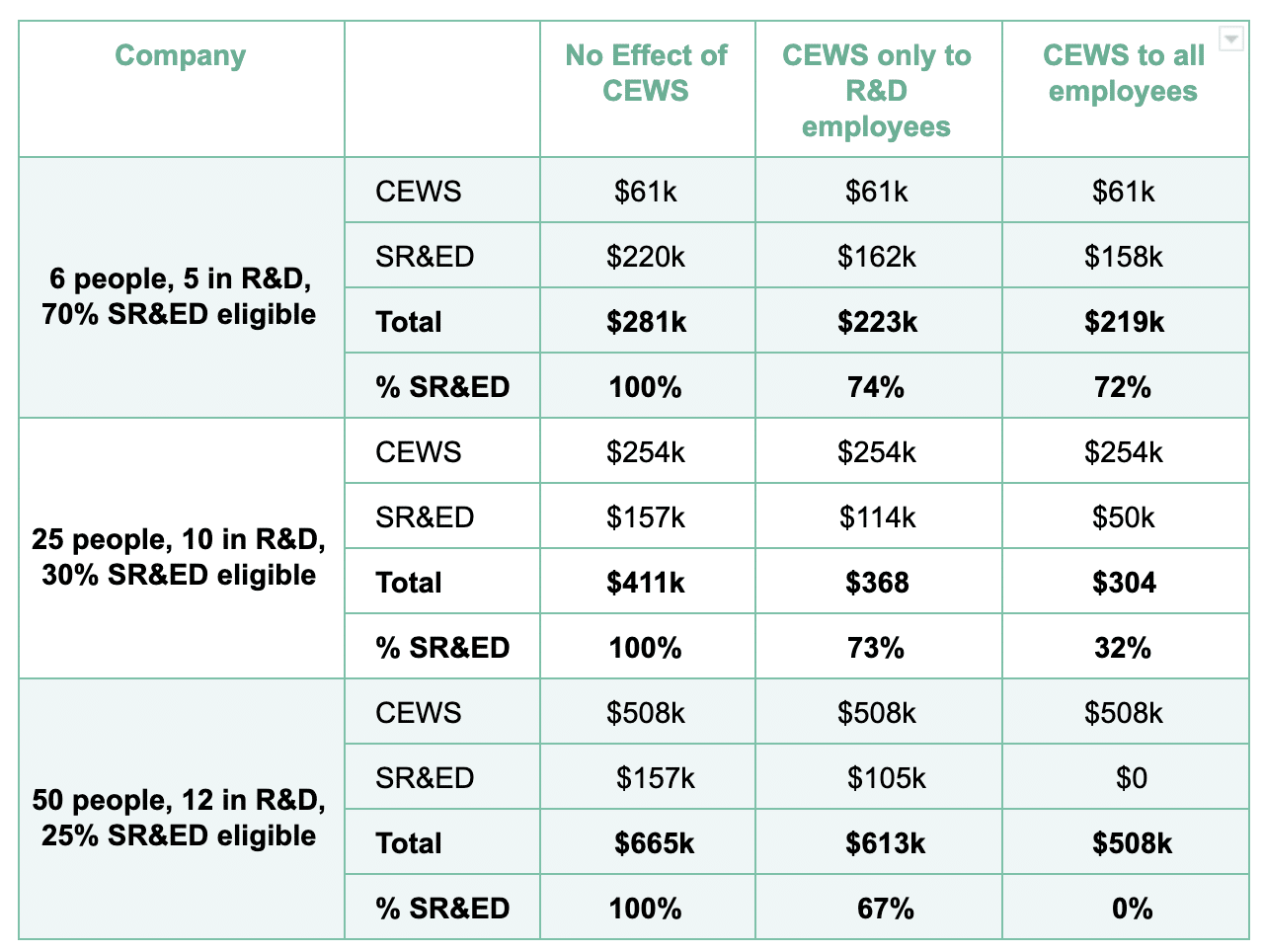

The matrix below represents different types of companies and different ways the CRA can treat CEWS. As provincial refund rates vary, we have used broad assumptions.

The columns represent the possible methods the CRA can use to determine the impact of government assistance:

- CEWS has no effect on the SR&ED claim.

- The CRA reduces the SR&ED claim by the CEWS for those employees involved with SR&ED-eligible activities

- The CRA counts the company’s entire CEWS benefit as government assistance to the SR&ED claim. Assuming that every employee in the company qualified for the full CEWS amount for the entire 3-month period.

The rows represent different types of companies. They’re all CCPC’s that qualify for the enhanced tax credit rate. The first is a small company that is very focused on R&D. The second company is a 25-person company that has already started to commercialize and the third is a 50-person medium-sized enterprise. For illustrative purposes, we have used a salary of $80,000/yr/pp.

What is clear is if the CRA attributes the CEWS claimed for all employees as government assistance to SR&ED, the SR&ED claims will be significantly impacted. We expect the CRA to pick the middle column where only CEWS for the employees involved with SR&ED will be dedicated as government assistance. In this case, you should plan for a 15% to 30% reduction in the size of your SR&ED refund.

If you would like an accurate assessment of the impact of CEWS on SR&ED, reach out to your accountant, SR&ED consultant or contact us and we’ll be happy to help. If you’re looking at other sources of funding for your company, check out our SR&ED Financing solution.