Reading Time: 14 minutes

If you’re a SaaS startup, chances are you’ve got an entire list of metrics or KPIs your team is watching. These help you gauge how well you’re doing and can help you assess if your company is growing – and how fast. If you’re a savvy startup, one of the most important metrics you should be watching is your churn rate.

If your startup’s goal is to become profitable, acquire funding, seek venture debt or to have a higher valuation, allowing hard-earned customers to leave isn’t going to get people excited about your long-term viability. That’s why you need to start paying attention to churn – and find ways to lower it.

And yet, 70% of SaaS companies have an unacceptable level of churn. This puts them at risk of never attracting funding, getting venture debt, having a high valuation, or even becoming profitable. This is why you need to have a plan to reduce churn and stop your customers from slipping away

What is Churn?

In SaaS terms, churn is the rate (in percentage) at which SaaS customers cancel their subscriptions.

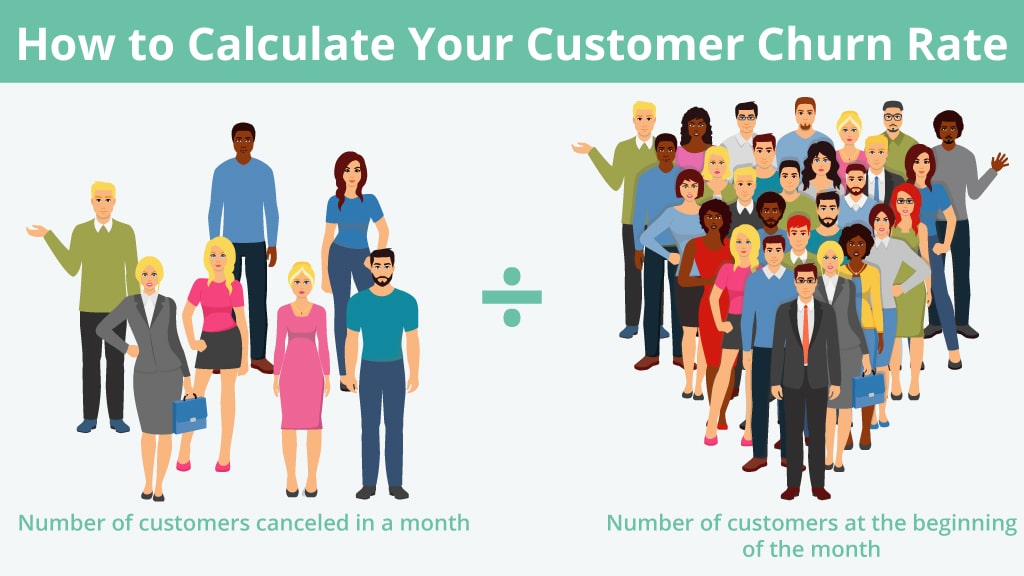

One simple way to calculate SaaS churn is by taking the number of customers cancelling per time interval and dividing that by the number of customers at the beginning of the interval. Here’s how to calculate a monthly churn, for example:

SaaS Churn = Total # of churned customers in current month / Total # of last month’s customers

Remember when calculating, to leave out how many customers have come into the system during this interval. For example, if you’re counting a monthly churn rate, you want to take the number of customers you started with that month (e.x.: 100), not the total amount of customers from that month (e.x.: 100 + 50 new signups). New acquisitions should be off the table, as to not skew your churn.

This is especially important to keep in mind for newer or growing companies since new customers tend to churn out faster than older clients that have stuck around for a while.

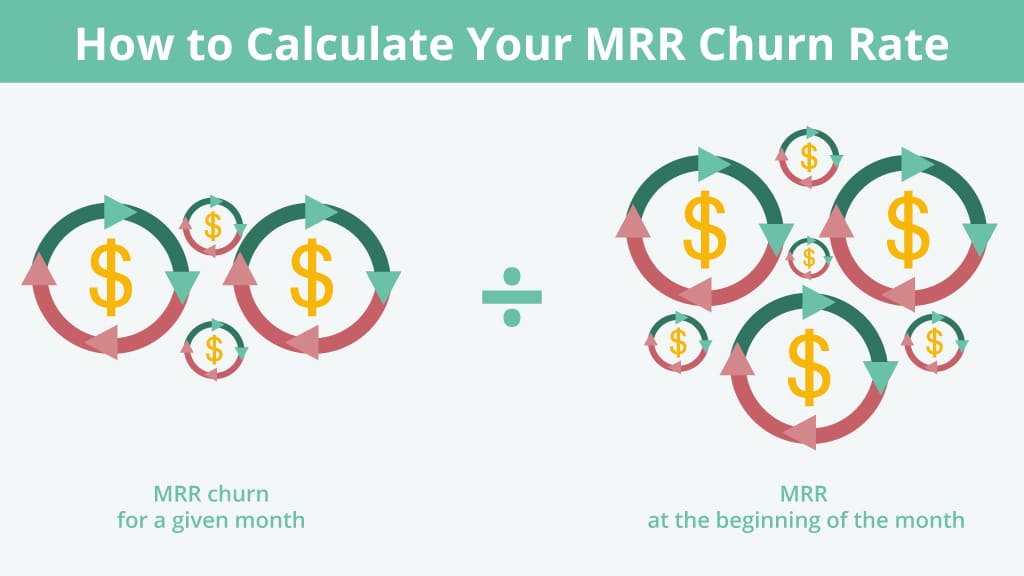

Another important type of SaaS churn rates is MRR Churn

MRR Churn: measures the erosion of monthly recurring revenue. (MRR = Monthly Recurring Revenue)

MRR Churn = MRR cancelled contracts for a given period of time / Total MRR at the beginning of the given time period

In short: when you’re measuring churn, you’re typically measuring two things: the number of customers churned, or the amount in dollars churned out. Each generally follows the same trend. They may diverge, however, if you’re losing very few customers, but those customers happen to be some of your highest-paying ones. That’s why it’s important to make a habit of monitoring both.

Why is SaaS Churn Rate Important?

The two key factors to a successful SaaS company are Customer Acquisition and Customer Retention. Beyond following these, there aren’t too many KPIs that will project just how healthy your company’s underlying premise is. Besides measuring CAC (Customer Acquisition Cost) and your MRR, following your churn closely will help you understand if your business is on stable ground (or not).

Churn is important for a variety of reasons, including:

- Showing historic business performance

- Being a key parameter in revenue forecasting

- An indication of the strength of your business model

- Identifying if platform changes have an adverse effect on your customer retention

- Helping you calculate the Lifetime Value of a customer

Of course, the reason why companies and investors are particularly interested in churn, especially in relation to SaaS start-ups, is that this specific metric is in direct opposition to growth. SaaS churn has a direct negative impact on profitability and company valuation. Think of churn as negative virality.

You spend a lot of time and energy acquiring customers in SaaS. This means you need to recover these costs over time. Your customers have to stick around for as long as possible to cover and then exceed the cost of acquiring them. If you can show that they’re sticking around for a long time, you’re showing the strength of the underlying tech – and your business model.

Is There an Ideal Churn Rate?

The ideal churn rate is the lowest possible percentage, but churn is usually to be expected, especially in startups that may still be tweaking their platform or their business model. Note that if you’re “doing the right thing” your churn rate will come down over time. What you should be aiming for is a 5% yearly churn rate, which translates into a 0.42-0.58% monthly churn rate.

Once again, the ideal situation is that the rate of churn is significantly less than the rate of new customer acquisition or revenue. While you want a consistent raise of new customers or revenues coming into your platform, you’ll also want a consistent or lowering rate of churn.

Expect Churn to Affect Fundraising Goals

If you’re a SaaS startup that’s in fundraising mode, expect the question of churn to come up at some point. Because it’s a key metric in revenue forecasting, it can help investors decide if your business model is viable…or not.

For example, if your churn rate sits at 10% while you are acquiring new customers at less than 10%, the churn rate will reveal your business is in decline. That’s not going to entice any savvy investors to bank on your business model. If an investor sees that you’re losing ground, instead of gaining, they won’t have faith that they’ll make money on the investment and take their funds elsewhere.

When it comes to venture debt, a high churn rate could also point to signs of mismanagement, and an unenthusiastic client base. A high churn rate could also indicate that your monthly recurring revenue (MRR) will decline. Since a SaaS loan is likely to be MRR based, lenders would be worried the startup won’t be able to pay back the money owed.

If you’re not sure how MRR Financing works, you need to read this blog.

So before raising capital or venture debt, it’s best to turn that churn around. Luckily, it’s a metric you can improve in a variety of ways.

It is Possible to Turn Your Numbers Around

Having a high churn rate doesn’t have to be a death knell – if you catch it early and commit to turning it around. Once you recognize that your churn rate may be a problem, you need to dig in a bit to understand why it’s so high before you can begin to fix it.

If you have an onboarding funnel, you may be able to pinpoint places where there’s a steep customer drop-off. Heat maps may be able to tell you which parts of your service are frustrating your clients. Or, you can do it the old-fashioned way and just ask via feedback pop-ups, email, chat support functions, or other outreach avenues.

Gathering feedback from your current clients will be invaluable. Their on-the-ground experience with your service will dictate everything from whether or not you add new features to how you will make improvements on a current design.

Another thing to consider is figuring out what kind of customer your service isn’t retaining and why.

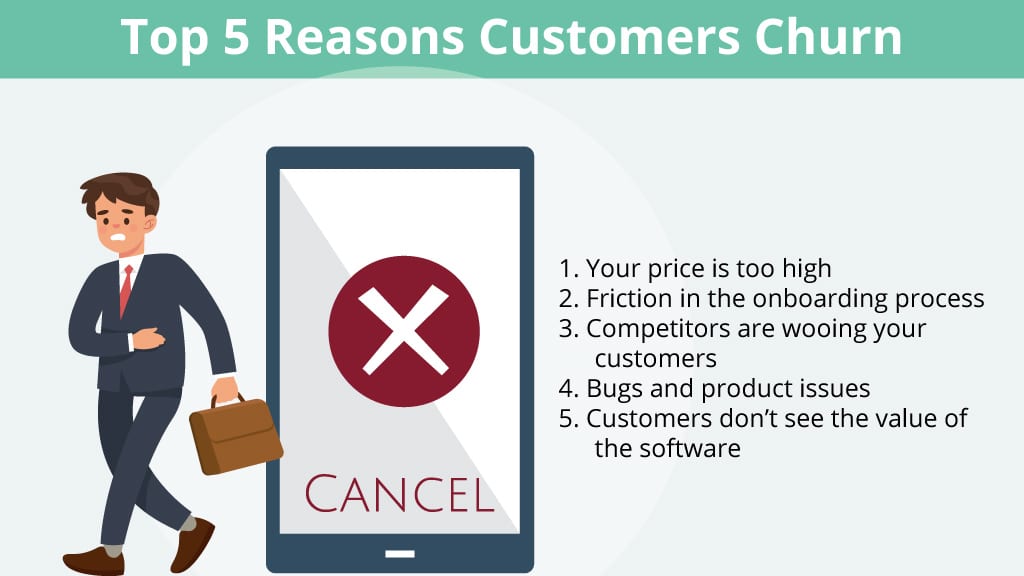

Reasons customers may be abandoning your software:

- Your price is too high

- They’re being wooed by competitors

- There’s too much friction in the onboarding process

- There are bugs or general product issues that prevent the user from utilizing the service

- The customer needs support or guidance – and simply isn’t getting any

- The customer receives no value in the service you’re offering

Some of these issues may be easier to address than others – such as bugs or price points. Others may be impossible hurdles to overcome – like if a client sees no value in the service offering. Start with the low-hanging fruit to make fixes that can help buoy your numbers. Then work to figure out where, over time, it’s possible to maintain a low churn rate.

Long Term Maintenance to Lower Churn

Once you’ve turned your numbers around, it’s time to focus on ways to constantly improve on or maintain an acceptable churn. This ensures you keep growing your client base and bringing revenue into your startup. It will also serve to impress potential investors or venture debt financiers.

Keeping churn low takes work. It also has the added benefit of keeping you in lockstep with your client base. Listening to their needs will help you adapt to trends and improve the right things. Ultimately, working on lowering churn ends up improving the overall product.

Tips to Keep Your Churn in Check

Be proactive

Being proactive doesn’t mean auto-sending welcome emails and/or exit interviews. Each, of course, is helpful in both setting up a curated client experience and mining information for later use. But what’s more important is to set up a system to reach out to customers before they need you. This shows you’re invested in helping them use your system to its fullest. Make sure the outreach is both timely and specific. For example, if someone signs onto a service and you notice they aren’t leveraging its potential, use it as an excuse to check-in.

Improve onboarding

Critical to a SaaS startup’s success is the onboarding of a new customer onto the system. If a client can’t figure out how to navigate your platform, they’ll quickly walk away. So keep it simple. To ease them in, set up a clear and concise onboarding process to guide the customer to the service’s features, functionalities, and processes. This is also a sneaky way to control the pace of how much information you’re surfacing to them. If your customer feels comfortable with the system and its layout early on, they will be less likely to leave. So never stop monitoring and refining the process to continuously remove friction.

Make it hard for customers to ignore you

Ultimately, the more a customer interacts with your service, the less likely they are to leave. The goal, then, is to get subscribers to interact with the service as frequently as possible. This can be achieved in a number of ways, including reinforcing benefits on invoices or having click-throughs to more content in emails and signatures. You can also send weekly or monthly emails full of how-tos or the latest service offerings.

Reinforce value

Remind your existing users that they truly are using the best product on the market. Let them know when you’re adding a new feature – and why. Reducing churn by sharing informative content will remind users of your service, and invite them back onto the platform. Don’t forget to point out when improvements are made. The idea is to continue to refine a product your customers never want to leave, so make sure you’re showing them just how hard you’re working to give them a service that serves them.

Add account managers

Sometimes a human touch is necessary. For big accounts and your most valued customers, having a dedicated member of staff to help troubleshoot problems or offer solutions can be a game-changer. Make sure your account managers are reaching out often and offering value – not just popping up whenever there’s a renewal on the horizon.

Focus on problem-solving and user experience

One of the easiest ways to achieve this is to simply ask your customers for feedback. They’ll happily tell you what works, what doesn’t, and what they wished they could do with your service. When designing new features, always have the user experience top-of-mind. Will this new feature make a customer’s experience with your product easier? Or does it unnecessarily complicate and confuse things? Even the simple act of moving or removing a button could be enough to frustrate a customer into leaving, so tread lightly on even the most cosmetic of changes.

Target the type of client that is loyal to your service

Begin this process by segmenting your existing clients into tranches to see if you can find commonalities between those who are your most loyal. Then, use those data points to go out and find more of the same. You can also look inward and re-engage with most profitable customers on the brink of churning. These customers have already proven themselves to be profitable (a very valuable reason to keep them on your team!). Don’t let them slip away. Seek them out and re-engage via a phone call, email, or promotion that just can’t say no to.

How Moz Re-engaged Customers via CTA Emails

It’s not just startups who see churn getting away from them. Longstanding SEO juggernaut Moz also grappled with churn. At the end of 2013, Moz witnessed an impressive 33% growth. What was lurking behind the scenes, however, was a 90-day 40% churn rate.

When Moz looked under the hood, what the numbers revealed was an issue with onboarding new customers. Clients were coming to Moz. They just weren’t sticking around. Moz had to visualize to them their value proposition because the customers just weren’t seeing it.

Moz was lucky, in that in their onboarding process they were able to gather valuable client information that could be used to supercharge their service offering. Because they knew which sites were linking to their client’s competitors, the company was able to work their magic to get those same sites to also link back to their clients. The result? Not only did Moz add SEO value to those at risk of churning out of their system, but they were also able to put a dollar amount on their action and added that right into the email. This wowed customers in a big way, making them feel important and making the service suddenly feel like a necessity for their business.

Moz proved their worth to their clients and showed them just how important they were to improve a customer’s SEO. Suddenly the clients who had disengaged saw a reason to stick with the service. Many re-engaged with the company in a big way. In the end, Moz discovered their 30-day churn rates dropped from 15% to 9%. That’s a 40% decrease.

Addressing Churn With Investors

If you’re fundraising, your churn rate will probably come up in the conversation, either early on in the process, or in a due diligence probe. It’s best to be forthright and honest about the numbers. Even if they aren’t perfect – yet – you need to show where you stand.

Use your pitch deck to visualize your prowess. If you can show an acceptable churn, great. If you can’t, show how you’re turning it around. This addresses the question without it having to be asked, and allows you to shape the narrative. Investors may probe for more data, but by putting the question of churn front and centre, the real conversation can begin. Instead of having the pitch devolve into defending why churn is so high, you’re steering the narrative towards how you’re making an even stronger product.

Tips to address churn in your pitch:

If Your Numbers Aren’t In Your Favour

If your churn rate isn’t quite where you’d like it to be, it’s best to show proactivity here and lay out your plans on implementing changes to lower churn. If you can illustrate how you’ve realized there’s a problem, and are actively involved in implementing solutions, it will go a long way in proving your management chops. It also shows an understanding of the market, your ability to course-correct, and ultimately build a stronger product.

These are all important positives for investors. But be ready to showcase the steps you’d like to take, and share a potential time frame in developing out the solution. Be ready to explain why you haven’t begun to mitigate the effects and to roll out an action plan that will address the issue.

If Your Numbers Are Beginning to Work in Your Favour

If you’ve started to pay attention to churn, you may have begun to implement fixes. If everything is going well, it means that, although your churn may still be high, it’s become visibly lower because of the adjustments you’ve made. Highlight them! Show how you’ve chipped away at a high churn rate and illustrate how you’ve begun to manage it. Include current and future plans to control churn to showcase how you’ve managed to pinpoint and mitigate concerns customers may have had with your product.

If Your Numbers Are Impressive

An impressive churn rate does not only prove your business model, it also gives you an opportunity to project future earnings. Make sure to show how you’ve lowered churn over time, and extrapolate on your numbers to calculate and visualize where your company can be in a few months (or years) based on moderate assumptions.

Whatever your numbers (and future plans) are, be sure to make them visual. Don’t just show bullets on a slide. Let investors see where you are going, or where you plan to be using charts, graphs, and statistics that map your progress and illustrate your strategic direction.

Also, take the time to explore other markets or possibilities. This shows how wide your scope is, and hints to potential investors that you aren’t making the mistake of limiting yourself to too small of a segment of your potential market cap.

The bottom line: there’s no hiding from your churn rate. It’s much better to be aware of the number – and how you can control it. Focus on your churn and avoid chasing vanity metrics. These may make your company look “good” but they don’t reveal the full story. Including them isn’t going to do you – or your potential investors – any favours.

Was this post helpful? Find more great insider information by signing up for our newsletter, including ways to help your company find growth capital or how to manage your next SR&ED submissions. We’re here to help you find venture debt to suit your needs. Let us show you how.