Canada is a startup hotbed, with Toronto and Vancouver ranked 11th and 19th respectively on Startup Blink’s ecosystem rating. That said, even with a supportive business environment and a robust network of funds, credits, and grant financing, building a successful startup remains statistically elusive. Even in Canada, not every entrepreneur makes it.

There’s no magic formula to make any business fail-proof. That doesn’t mean, however, that there aren’t lessons to be learned or things to avoid that will amplify your likelihood of success. Dissecting what the main causes of failure are and comparing them against best practices for success can lead to some very valuable insights.

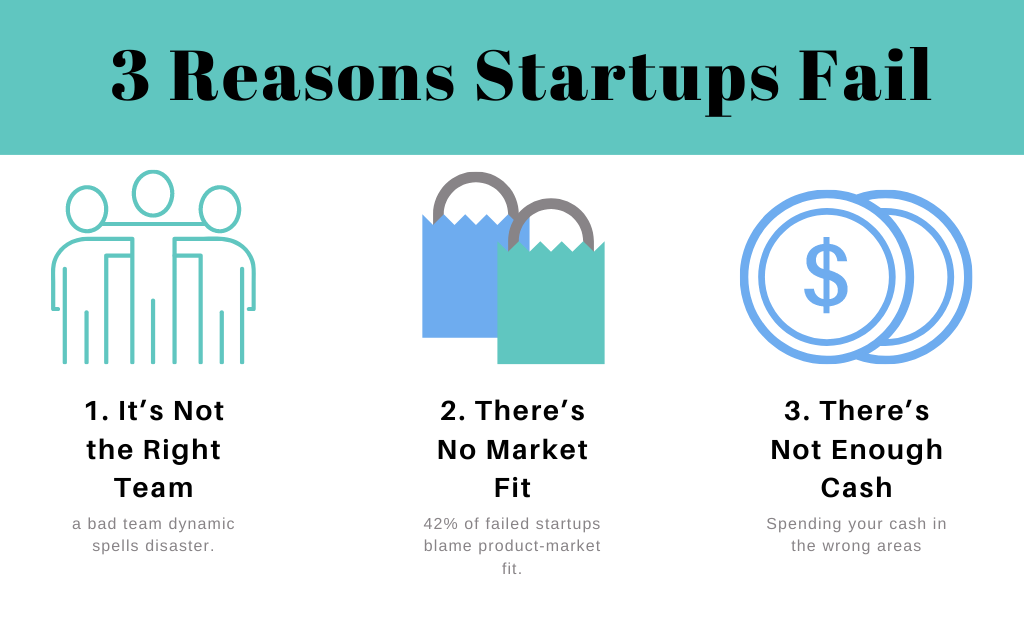

So, Why Do Startups Fail?

1. It’s Not the Right Team

Having the right team in place is integral to the health of a business at any stage. With startups, in particular, a bad team spells disaster. As there is very little room for error, any executive misstep can cost the company dearly. And having the wrong foundational team can sink the ship. Ziversity, a Canadian SaaS startup, for example, blamed its team dynamic as one of the contributing factors to its ultimate demise.

In fact, after multiple years of research, Harvard Business School has found that first-time startup founders make grave mistakes when deciding how the founding team is structured. These mistakes end up having disastrous consequences on the longevity of a company.

Teams that fight each other on direction, argue over ownership and control or hire the wrong essential staff members aren’t going to make it past the crucial first year or two. Why? Focusing on negative internal dynamics and showing a divided front to staff, advisors and investors make everyone nervous and traction nearly impossible.

2. There’s No Market Fit

It seems strange that a business would fail because there wasn’t a market fit. It begs the question: didn’t the founder do any up-front research first? Surprisingly, many startups fall in love with their idea while forgoing the finer details. Important first steps, like getting feedback from family, friends, potential clients and users simply never happens. In a recent study, 42% of failed startups blamed product-market fit. Lack of product-market fit could include misunderstanding customers’ true needs, missing the window on relevancy, or expecting too much from customers. Such errors could be fatal for a startup.

While a select few Canadian entrepreneurs put in the time to do some market research, and find out if there is an actual need or any viable market share, sadly many others jump in feet first with little to no research or true understanding of their market and quickly get disillusioned in the process. Once disillusionment sets in, any bump in the road can lead to a company fizzling out, and usually those bumps are related to cash flow.

3. There’s Not Enough Cash

Another typical reason startups fail is simply an inability to master cash flow. Many startups do not have the funds at hand to cover setup and operational costs. Similarly, companies with large coffers run the risk of over-spending or over-investing. Companies often use their money for exactly the wrong things, typically because there aren’t proper processes in place to dictate where cash is needed. Lacking a clear runway in advance, and refocusing energy away from priorities, startups don’t always see the wall coming until they hit it. By then, it’s often too late.

As daunting as overcoming these barriers may seem, there is a variety of startup success stories. Those that succeed tend to shift their focus outward to find solutions and support that ultimately pay dividends in the form of accelerated growth and longevity.

Why Do Startups Succeed?

We’ve covered how when you get it wrong, it can be the end of your company. Yet, when the stars align and you have the right founding team in place, it can make your business one of the great success stories on the Canadian startup scene.

1. Strong Founding Team

As Noah Dolgoy points out, one of the few variables that a startup founder can control is the founding team. By being selective and curating a team that’s ready to carry the ball over the goal line, startups exponentially improve their success rate. Why? Because a strong founding team understands that no one person is fantastic at every nuance of running a business. By seeking out individuals that have different strengths, like startup success, Therapia (which has the unusual distinction of having 6 co-founders), diversity of voices and team cohesion can be used to enhance that company’s bottom line.

Often, the most successful teams are comprised of people that know each other or have worked together in the past. This is because there’s a great amount of trust and reliance on each individual in the early stage of a company that may have limited resources at its fingertips. How do you find people if you don’t already have them in your circle? That’s where secret #2 comes in.

2. Effectively Utilized Network

Startups that succeed realize early on that they can’t do it alone and actively work to expand their circles. This means utilizing existing networks that can help source key hires, strategic advisors, and even potential funding sources.

Networks can provide startups with access to potential talent pools or seed capital. They might also provide client leads, strategic partnerships and are effective at evangelizing a startup. Needless to say, a strong network surrounding a new venture helps support and nurture it through its many early growing pains.

3. Efficient Use of Funds

Leveraging networks isn’t the only thing successful startups do right. Businesses at any stage need to be smart with their cash flow. This is especially true in the earliest days when steady funds are not be rolling in and margins are razor-thin. Marrying a clear vision with a strong founding team aligned in goals will help focus spend priorities.

Being smart with funds isn’t just about being careful with the cash that the company has readily available. It also means being smart at sourcing new funding. Friends and family financing only goes so far, but successful companies also know that funding in the form of tax credits like SR&ED, angel investment or VC organizations can help the company access sometimes critical funds. These alternative funding sources give startups time to grow their customer bases, income, and product readiness. This is especially important for startups in newly developing or innovation sectors where the industry itself is still growing and acquiring traction.

Are you a startup seeking a path to success? Venbridge helps build great companies by offering non-dilutive venture debt and tax credit consulting services. At Venbridge we’re not bankers, we’re technology leaders just like you, and we understand how to bring value to SMEs. Contact us today.