One of the biggest concerns founders and CEOs have is raising capital to maintain runway until reaching profitability. Over the years, founders have often focused on venture capital and funding rounds. As a result, they frequently overlook venture debt as a way to boost their company’s finances. Simply put, when you raise capital you are essentially buying money with equity whereas, with venture debt, you’re buying money with interest. What’s more, acquiring venture debt is fast, efficient, and allows founders to hold onto more of their company’s ownership longer than with other sources of capital.

Because equity funding is so time-consuming and less accessible these days, if you’re a startup with a short cash runway, you might not have the luxury of spending months chasing VCs or pitching to angel investors. That’s when the speed of venture debt really comes in handy.

What is venture debt?

Venture debt is a type of non-dilutive debt financing for early and growth-stage companies. Simply put, venture debt adds capital to the company as a term loan or a line of credit to fund growth or extend cash runway. Since many startups have few physical assets as collateral, they would not qualify for a traditional bank loan. With venture debt, other forms of assets, such as tax credits, recurring revenue, and purchase orders can be leveraged for a credit facility.

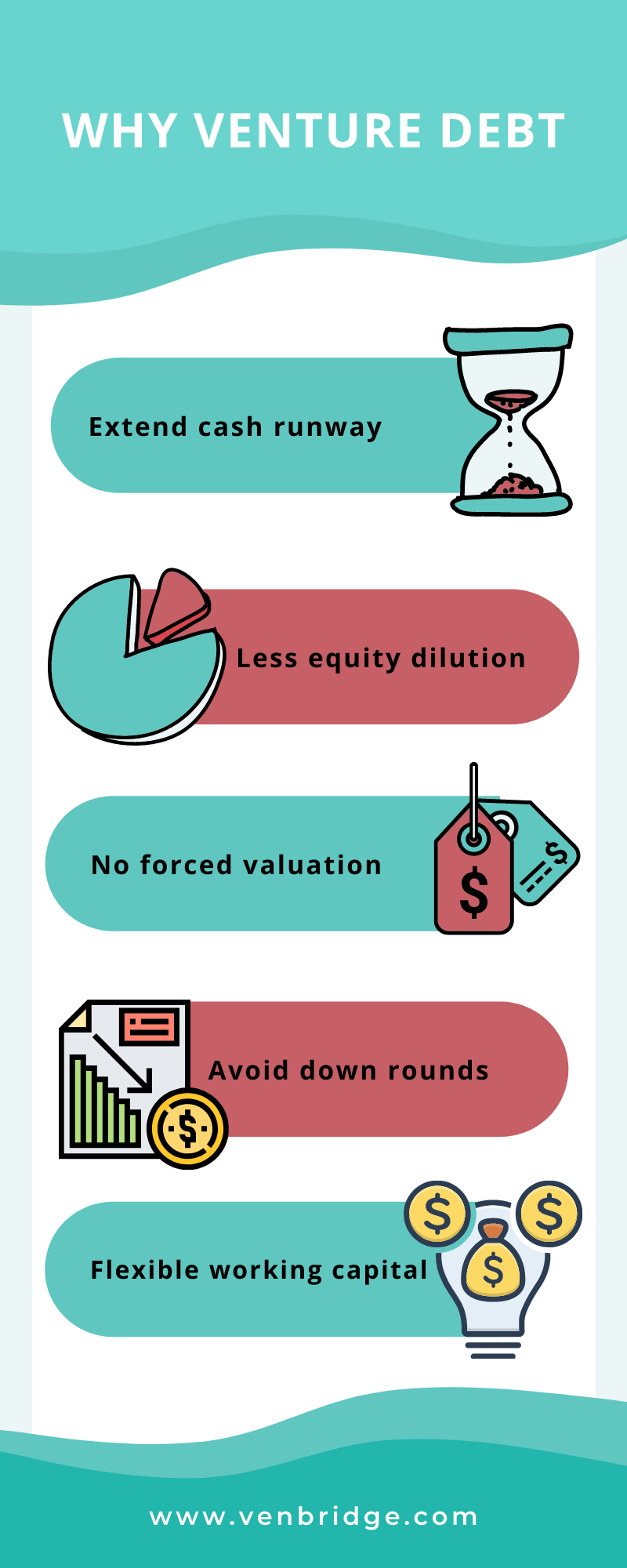

Why Choose Venture Debt?

Many startups try to raise equity right away when they need to raise funds for their business. But an early-stage startup equity raise can have quite a few repercussions, including:

- Time: Raising money through equity is often a long and difficult process.

- Dilution: Diluting too early can lead to a loss of control over the direction of the business.

- Loss of board seats: This means you’ll need to get your equity investors’ approval on everything from staffing decisions to the strategic direction of the startup.

- Forced valuation: While this isn’t bad per se, it could be a problem in some cases. For example, if the company is growing quickly or hitting key milestones where it would be better to defer valuation until the company will be worth more.

With significant downsides to seeking equity too early in a startup’s lifecycle, many savvy founders look into other avenues to acquire the funding needed to ensure their young business has enough runway to succeed. One of those avenues is venture debt.

Benefits of Venture Debt

- Venture debt is generally less expensive than equity.

- The process for venture debt is straightforward and much faster than an equity round which takes months.

- Adding debt allows you to grow your business and have a higher valuation when raising equity.

- When you get venture debt, you get to maintain control over your business.

- It’s also flexible, meaning you can combine venture debt with senior debt from a bank to reduce your overall debt capital costs.

- Venture debt is non-dilutive, which allows companies to create greater economic value for founders, employees and early supporters.

What can you do with your loan?

How you put the cash from your loan to use is up to you, usually with a few limitations that we will discuss later on.

Borrowers usually choose to invest the money in growth activities such as:

- Sales and marketing initiatives.

- Product development acceleration and efficiency improvements.

- Payroll in a cash crunch.

- Increasing working capital to keep operations going.

- Business scaling.

- Strategic hires.

These aren’t the only reasons venture debt is attractive. Since it has a relatively quick turnaround (between seeking debt and getting money in the bank), venture debt allows companies to:

- Extend their runway to give them time to hit their next goal.

- Build their valuations ahead of equity rounds.

- Finance big-ticket, one-time acquisitions.

- Conserve cash before an economic downturn.

- Purchase materials for manufacturing

- Avoid another equity round (and therefore more dilution).

- Fund a dividend recap.

- If a company is eligible for a grant or a tax credit (such as SR&ED), venture debt also can act as a bridge loan to help the company

- continue operations while they await their cash.

What can you not do with your venture loan?

What you can’t do with your venture debt is typically outlined in your covenants. Covenants can sometimes be negotiated, depending on your position, the type of loan and the nature of the venture debt provider you are in conversation with.

Keep in mind that if your lender is including an excessive amount of covenants in your agreement, it could be a sign that they are risk-averse. This means they may not be as supportive should your startup hit a few bumps in the road.

There are two types of covenants:

- Financial. These may cover provisions such as hitting a certain revenue target or ensuring your startup has a specific amount of cash on hand. Financial covenants typically are reserved for more established companies that may have a more stable income. Startups, which traditionally have more volatile cash flow, may be able to avoid at least a few financial covenants.

- Non-financial. These covenants prevent the business owner from engaging in specific acts such as selling the company.

Should you decide to go ahead with a decision clearly prohibited in your loan agreement, you would be in breach of the agreement, and it would cause your company to default on the loan.

Expect to have at least a few covenants on your loan. These covenants may include stipulations such as:

- Approval of payment of any existing debt or taking on new debt with your loan

- Approval of any merger or acquisition

- Approval before purchasing or selling long-term assets

- Prohibition of adding additional liens to collateral promised to the original lender (should the loan default)

- Approval before issuing dividends

- Agreement to send audited financial statements to the lender

- Agreement to stay current with taxes

- Agreement that any subsequent loans are secondary to the lender’s original loan unless stated otherwise

At Venbridge, we keep our covenants limited so startups can invest in the areas they think are best.

Is Venture Debt The Right Choice For You?

While venture debt has a lot of upsides, it’s not right for every business or for every stage. There are several circumstances in which venture debt would not be your startup’s best option, including:

- There is no clear use for the capital

It’s extremely important to use borrowed funds in business areas that create value. If your company has excess debt capital on your balance sheet, it simply shows an added cost with no discernible benefit. The same is true of raising excess equity, as it would cause unnecessary dilution.

- If your business is not achieving Product-Market Fit

If your company hasn’t found its fit in the market, it would be too early for the large majority of venture capital firms. Venture debt could be the answer if you’re on your way to achieving product-market fit as some debt providers, such as Venbridge, specialize in empowering up-and-coming startups. However, if you’re not confident your business can make its monthly fixed interest payment as well as the principal paid at the end of the term, then venture debt is not the right choice for you.

- If your business has declining Revenue/Margin/Profit with no plan for improvement

Fast-growing companies use venture debt when the value created via capital investment exceeds the cost of capital. For example, if you are only growing by 5%, it doesn’t make sense to borrow at 15% interest unless it’s to bridge a gap or to get over a temporary dip in your finances. Similarly, if your customer acquisition costs are getting higher, or your churn rate is increasing and you don’t have a plan for improving these metrics, a loan isn’t going to make sense.

What To Look For In Venture Debt

There are various lenders that provide venture debt in Canada, but not all work in the same way. As a business, it’s important to do your own due diligence on any venture debt organization to understand the structure and terms involved with the debt financing. Make sure the solutions on offer will ultimately work with your long-term raise strategy.

Look for a partner that:

- Believes in your business

Pick a funder that takes the time to understand your business model, concept, and long-term goals and then finds the best way to help you achieve them. Your funder can look for ways to combine different assets to give you a bigger loan, negotiate repayment, and introduce you to key people to kick off your business.

- Is flexible

You may want to increase funding as your startup grows or prepay your loan without penalties. A lender that is rigid or has significant early-payment penalties could stifle your startup and risk your organization’s ability to execute on its ability to raise additional capital in the future.

- Has an all-in cost structure

Seek out venture debt that offers transparent and simple pricing.

- Offers capital efficiency

If the debt requires a startup to draw down on the entire amount of the loan upfront, it can mean the company is paying interest on excess capital. As an alternative, look for loan structures that allow your startup to draw multiple disbursements as necessary.

- Is comfortable with the risk

Look for debt providers with a proven track record of being founder-friendly, and a reputation for being able to support when things don’t go exactly as planned. A seasoned lender will work with your company to overcome challenges and find the optimal outcome for all stakeholders – not just themselves.

- Doesn’t have restrictive or excessive covenants

As venture debt is meant to work as growth capital and bear more risk, it should have fewer covenants than traditional working capital loans. Of course, because of this, it is priced accordingly. However, covenants included in the agreement should be appropriate for startups using the capital to fund growth and may have no operating cash flow. Be mindful to avoid organizations that mask senior loans as venture debt. These deals may have excessive covenants which end up increasing the risk of default or reducing the capital that’s available to be drawn down.

What Can You Finance

Since most startups don’t have traditional assets that can be used for loan collateral, non-conventional assets can be used. These may vary depending on your startup. For example, you can get a facility backed by:

- Your MMR (if you are a SaaS company)

- Your SR&ED refund (if you conduct R&D activities)

- Other tax credits such as the Interactive Digital Media Tax Credit (IDMTC)

- Grants and other tax incentives

- Loans and receivables

- Intellectual Property (IP) and patents

- A mix of collateral, including real estate, vehicles, machinery, or insurance policies

- Future equity raising rounds

The loan process

Unlike equity which can be a long and drawn-out process, venture debt often has a short deployment time.

The main phases of the loan process are:

1. Investment Screening. The screening process is usually over a call or an online portal, whereby the borrower and lender work to find if there is a potential fit. Often, the lender will ask the company to provide financial information. This step helps the lender to conduct pre-due diligence.

2. Term Sheet. A term sheet will then be signed. This document typically includes a clear outline of all material terms of the transaction. Be sure to ask for a term sheet early in the process to give you a better sense of the facility. This will help you to determine if the offer is right for you, and will save you from investing the time in due diligence if it is not a good fit. Also, remember that some terms might be negotiable to best fit your needs and expectations.

3. Due Diligence and Investment Approval. The lender’s team will examine your startup and its financial, legal, and operational status. This process determines the overall creditworthiness of the company. Once the due diligence is completed, your file is submitted to the lender’s credit committee for approval.

4. Legal and Funding. If your loan is approved, the funder will provide you with its legal and funding documentation. Note that legal documentation and expenses vary between lenders. Seek to confirm the approximate legal expenses in advance. Look for streamlined legal and funding documentation to help speed up the process and reduce costs. Once finalized and if there are no remaining legal concerns, the funds should be ready for release.

In some cases, you may re-engage with your lender to initiate new facilities as your company’s capital requirements evolve and grow. This possibility is one of many reasons why you should strategically select your next funding partner.

SR&ED financing

In Canada, venture debt firms, like Venbridge, provide SR&ED loans. The Scientific Research and Experimental Development (SR&ED) program is a multi-billion dollar federal and provincial tax incentive program offered by the Canadian Revenue Agency (CRA) to support and encourage Canadian businesses to conduct research and development in Canada. If you’re a tech company, you probably know about SR&ED, but you may not be aware that you can find debt financing based on your SR&ED claim.

SR&ED Financing is a type of loan designed to provide businesses that have qualified for SR&ED tax credits with working capital. The size of the loan is based on their tax credit amount. Essentially, you are borrowing to get your SR&ED refund early so you can put it to good use instead of waiting out CRA’s refund process.

Receipt of funds from filing a SR&ED claim usually takes anywhere from 30 to 180 days, and wait times for these refunds may affect your cash flow. With SR&ED financing, you can get almost immediate access to the cash that’s coming your way. It’s basically an instant refund.

Typically businesses will get financed for between 70% to 80% of their expected SR&ED claim. When you get your cash early, you can use it to fund your business and/or invest in R&D without diluting your equity or spending your time fundraising.

Often funders will loan against accrued SR&ED. Therefore, if you have finished a portion of your fiscal year, you can receive a loan based on the estimated amount of SR&ED eligible activities to date.

SR&ED financing: designed for fast turnaround

The great thing about SR&ED Financing (or SR&ED loan) is that it’s quick. You can get the cash flow you need to perform more R&D or to expand in a matter of days. The best companies will be able to accurately qualify your request within 30 minutes and provide a term sheet within 24 hours. After you sign the term sheet, there is a period where the underwriters conduct due diligence. This can take anywhere from 3 to 30 days. At Venbridge, the whole process typically takes a week.

Once the credit committee approves the loan, the funds are usually in your account within a day (via wire). Therefore, the best SR&ED finance companies will fund in 5 to 10 days. Slower companies can take as long as 30 days from signing the term sheet.

The final word of caution is that there is nothing more frustrating than selecting a SR&ED financing company or venture debt firm, signing a term sheet, and going through due diligence just to be rejected by the credit committee. You will have wasted valuable time and resources just to be back at the start line now with even more pressure on your cash flow. To mitigate this uncertainty, interview the company. Ask them how many claims they have financed, what percent they reject at the credit committee, and if your contact will be on the credit committee to support your case. Having these questions answered in advance will offer you peace of mind that as long as your representations before signing the term sheet are accurate, your loan is likely to be approved.

How much does venture debt cost?

While most factors aren’t negotiable, aside from covenants, costs vary according to the terms of the deal and the venture debt lender. These key factors all play a part in how much your loan will ultimately cost:

Risk

This is one of the biggest determining factors in how much your loan will ultimately cost. Companies are evaluated on how likely they are to repay their loan, and the details of the terms will reflect the risk associated with the likelihood of repayment. For example: if you are a SaaS company and you have a high churn, a high burn rate and low revenue, your company will be considered riskier than a company with growing revenue, significant equity and venture capitalists backing it.

Loan size

Naturally, a larger loan size will lead to more interest payments. However, calculations based on your balance sheet or monthly revenue will likely determine the loan size for which you’ll qualify. If you want to reduce the debt on your balance sheet, attempt to ensure the minimum loan duration is reasonable or that you are comfortable with the amount stipulated.

Cost of capital

This includes interest rates and other fees/costs such as legal and placement fees.

Repayment terms

Your economics will be impacted by your amortization and loan repayment periods. You may be able to negotiate if your loan is revolving (or not) as well as the dates of fixed drawdown periods. Remember to only drawdown when you need the capital in order to reduce your accrued interest.

Warrants

You can negotiate the number of warrants and the cost at which they are granted. However, if a lender is looking for warrants as a loan condition, you may not be able to fully negotiate them away. Be aware that warrants are dilutive, and therefore instead of repaying them in cash flows, you’ll be repaying them through sale/IPO proceeds. Even with this being the case, when calculating the cost of capital, make sure to factor them in.

Covenants

It’s common to have revenue and burn covenants. However, different lenders typically have different ratios or metrics that they use. Make sure you gain clarity on what consequences you will face if you fail to hit the covenants outlined in your debt agreement.

Be cautious when it comes to prepaid interest because it increases the cost of capital. There are some companies that require the borrower to prepay interest.

For example, let’s compare a $100k loan where the interest rate is 18.0% per year and one lender has no holdback and a second lender has a 6-month holdback. The second lender would hold back $100k x 18.0% x 6 months ÷ 12 months = $9k. Therefore, the second lender would disburse $91k compared to $100k for the first lender. The effective interest rate of the second lender is 18.0% x 100,000 ÷ 91,000 = 19.8%. Therefore, not only are you paying 1.8% more interest per year, but you have $9k less of working capital. Try to avoid lenders that have a holdback, or at least ensure you understand the ramifications from an interest rate and cash flow perspective.

For startups (Seed stage to Series B), you can expect to be paying anywhere from 10%-20% (in addition to warrants) on a loan. Although this seems high, there is a certain level of risk a debt lender takes on. The high yield is meant to compensate for taking on this risk. Terms can vary but are typically anywhere from three to five years. Debt lenders must be paid out before equity investors.

In terms of SR&ED financing, it, like venture debt, typically costs more than a traditional bank loan and often times less than equity. The average interest rate for SR&ED financing is between 12% to 25% per year. However, most founders don’t look at the annualized cost of the loan because SR&ED financing is usually a bridge loan which is less than a year.

How to repay your loan

The way a startup is required to repay the loan can vary. Repayment may involve immediate amortization in the payment structure, or it might mean a period of interest-only payments followed by principal and interest payments. Warrants are often considered an important component and may average 8-12% of the loan. No matter the type of repayment terms, your organization can expect to pay a certain monthly amount to the lender until the end of the term, or until the debt has been fully repaid.

SR&ED repayment schemes

If your venture debt is financed via your SR&ED tax credit, there are a few ways the payback agreement may be structured. There are a few key areas to consider:

- Interest payments: Most SR&ED lenders will accrue interest until the SR&ED credit is refunded. What that means is that you don’t have monthly interest payments.

- Balloon payments: A balloon payment is a repayment of the outstanding loan balance made at the end of the loan period. For most SR&ED lenders, this is the typical method for repaying a SR&ED loan. When the CRA issues the SR&ED refund, the borrower pays the lender the principal plus interest and any fees. Any funds left over at this point are retained by the borrower.

- Pay to a trust account, to a lender, or to a borrower: Lenders will have the CRA refund check directed to a lawyer, the borrower, the lender or a new bank account which the borrower sets up with the lender. There is a lot more paperwork and administration when setting up a new bank account and therefore this is a less desirable approach.

- Maximum term of loan: The maximum term of the loan can be an important feature. Some loans may not have a maximum term and therefore, if the SR&ED refund is insufficient to repay the loan, you may have an unlimited time to repay the facility. Most lenders add a maximum term of the loan which will adequately account for circumstances in which the CRA selects the claim for review. At this point, if the SR&ED claim is insufficient to repay the loan, there may be a balloon payment or a negotiation of how to repay the lender.

- Minimum term of loan: Some lenders have a minimum loan duration. This is effectively a minimum amount of interest. The CRA may issue a refund cheque very shortly after the lender disburses the loan. If this happens, and there is a minimum loan duration, the borrower will repay the loan along with interest based on the minimum term of the loan.

- Partial payment: There are multiple scenarios in which partial payment of the loan may be acceptable. A good lender will allow you to repay all or some of the loan without penalty. This is important as your fundraising activities may allow you to repay the loan, in which case you may be able to avoid paying extra fees.

SR&ED refund does not repay the facility:

The SR&ED refund may be less than the amount owed to the borrower. In these circumstances, some lenders allow you to repay the loan from the next year’s SR&ED claim, some want the loan repaid immediately, and others will negotiate a settlement. Find a flexible lender who cares about your success just as much as they care about getting their money back.

How Recurring Revenue Financing repayment works

Recurring revenue credit facilities will function as either “amortizing” or “bullet” loans. Bullets delay payment of most or the entire principal to the maturity date of the facility. Throughout the life of a bullet loan, borrowers will make monthly or quarterly interest payments. Typically bullet loans are only available for larger, venture-backed borrowers.

Under the amortizing loan model, the principal balance outstanding declines as you make periodic payments. An amortized recurring revenue credit facility can function as a traditional amortizing facility such as mortgages with fixed periodic payments. It can also be structured with added flexibility, including making periodic payments variable or adding “Interest-Only” or “Payment Holiday” periods to the loan. Typically, variable payments are structured as a percentage of the borrowing company’s monthly or quarterly GAAP revenue. This way, repayment flexes with incoming cash over the period of the loan. This flexibility gives you some leeway if you have a tough month, but you pay sooner as revenue grows. The added flexibility will, however, usually result in the lender seeking additional security, high prepayment penalties, or other forms of compensation for the incremental risk.

Remember that ultimately, each transaction is the result of a successful negotiation between the lender and the borrower.